|

|

|

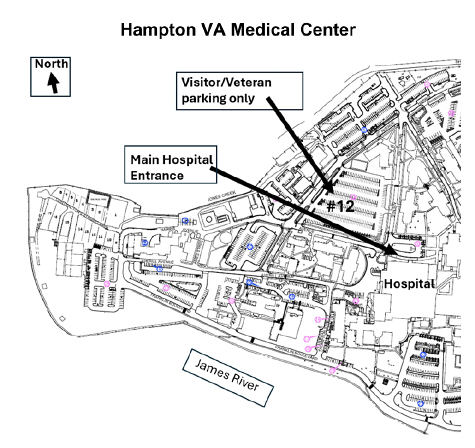

Improved Parking

at

Hampton VA Medical Center

|

| I am pleased to

share an important update that reflects our ongoing commitment to ensuring

our Veterans have accessible, timely, and respectful care at the Hampton

VA Medical Center.

In direct response

to feedback from our Veteran community, we have implemented several improvements

to expand and enhance parking availability for our Veterans and visitors.

Through a strategic review of existing parking assets and by relocating

staff parking farther out within our campus, we have created additional

space closer to our main facility where itís needed most.

We are proud to announce

the following changes:

-

70 new Veteran/visitor

parking spaces have been added near the main facility.

-

59 additional general

parking spaces are now available in closer proximity to high-traffic areas.

-

Parking Lot 12 is now

designated exclusively for Veterans and visitors from 0700 to 1600 on business

days.

-

Our campus shuttle service

has been expanded and improved, providing more frequent and convenient

access throughout the facility.

-

Through a partnership

with Hampton University, staff and vistiors have access to a satellite

parking lot just outside our front gates on Emancipation Drive.

-

You will also notice

new signage throughout the parking lots clearly identifying updated parking

assignments and shuttle stop locations.

We have already received

very positive feedback from Veterans regarding the improved accessibility,

and we want to ensure you are aware of these efforts designed to prioritize

those we are honored to serve.

Please see the below

map for details on the updated parking layout, including the dedicated

Lot 12.

Should you have any

questions or need additional information, please reach out to our Public

Affairs Officer, John Rogers, at john.rogers12@va.gov.

Thank you for your

continued support and partnership in serving our nationís Veterans.

Sincerely,

V/R

Michael W. Harper,

RT(R), MHR, MBA

Interim

Executive Director

Hampton

VA Healthcare System

U.S.

Departmernt of Veterans Affairs

Office:

757-722-9961 ext. 3101

|

Click on map for high resolution

file you can print

|

|

|

Voice Your Opinion

|

| A mixed use residential/retail/parking

structure is being proposed for construction immediately behind the Tidewater

Veterans Memorial.

The Virginia Beach

City Councilís strategic plan does not protect or acknowledge the significance

of the Memorial in its current location.

If you are interested

in voicing your opinion on protecting the historical and symbolic significance

of the Memorial,

Thre link below takes

you to an example of a letter that has been sent to city council.

The letter may be edited or modified to state your own concerns and opinion

about the proposed construction and impacts on the Memorial and your chapter

board is encouraging you to voice your opinion.

Letter

Sent to City Council about Veterans Memorial

Template

you can edit and send to City Council

Even if you are not

a VB resident, this is a Veterans Memorial for all of Tidewater.

(Correspondence

to VB City Council should be by US Mail) |

|

|

SUPPORT

OUR VETERANS!!!

|

Hampton Roads Council of

Veterans Organizations (HRCVO)

Coordinates Donations to

The Jones & Cabacoy Veterans Care

Center

in Virginia Beach

WE NEED YOUR HELP!!!

Click

Here for poster with items you can donate

|

|

|

New Military ID CARD

Requirement

|

The following information

was originally developed by our own Jim Daniels. At a MEDAC Meeting

I asked CAPT Gray, Commanding Officer Joint Expeditionary Base Little Creek-Fort

Story, if he would sort through Jimís research and the various contrary

responses we have received on this subject. He responded with definitive

information that confirms and embellished Jim Daniels research. The

following is the information that you all should have. It will be

published in the next HRCMOAA Newsletter.

-

New ID Cardís will be

required by 31 December 2025. However, it is highly recommended that

retirees get the new cards as soon as possible, especially if their social

security number is on their card.

-

Using the old ID Card

will not affect the ability to fill prescriptions.

-

You must be 65 to get

the INDEF ID card.

-

The website to make

an appointment is: https://idco.dmdc.osd.mil/idco/

-

This will connect to

NAS Oceana, NAB Little Creek, Fort Story, NS Norfolk and all Hampton Roads

area ID Card offices.

-

To get an ID Card without

going to the ID Card office, you will be required to create a DS Logon.

-

Previous ID card photo

will be used.

Corrected Phone Numbers

to ID Card Offices:

NAS Oceana:

757-433-2184

Norfolk: 757-444-8263

NAB Little Creek:

757-462-5319

Dam Neck: 757-492-6163

NMC Portsmouth: 757-953-7874

Langley AFB: 757-764-2270

Respectfully

Submitted;

John J. Uhrin III,

CDR USN (Ret.)

PS by Webmaster:

New military ID

cards also function as a Real ID at airport TSA checkpoints. This

has been tested at two major airports in March 2025. |

|

|

REAL ID DEADLINE

|

|

| The deadline for getting a REAL ID is

May 7 (although the TSA has announced that enforcement may be phased in).

As of that date, every air traveler who is at least 18 years old will need

a REAL ID-compliant driverís license or identification card or another

TSA-acceptable form of identification for domestic air travel and to enter

certain federal facilities.

Other TSA-acceptable documents are active

passports, passport cards or Global Entry cards. Standard drivers licenses

will no longer be valid ID for TSA purposes, but enhanced drivers licenses

from certain states are acceptable alternatives.

Travelers who don't have a REAL ID by the

deadline could face delays at airport security checkpoints.

Visit the TSA website at tsa.gov

for updates and information.

More information available at this TSA.gov

link:

tsa.gov/travel/security-screening/identification |

|

|

|

| MOAA has published an article on their

website about the TRICARE for Life Enrollment Fees, Cost Shares

Part of New Budget Report.

By: Karen Ruedisueli, Jan 15, 2025

The Congressional Budget Office (CBO) has

once again targeted TRICARE For Life (TFL) in its biennial report outlining

options for reducing the deficit.

The

December 2024 report highlights savings that could be achieved by introducing

a TFL enrollment fee or minimum out-of-pocket cost requirements. Similar

concepts have been presented in past

CBO reports, which are issued every two years to provide information

to lawmakers confronting budgetary challenges.

Last year, nearly 200 MOAA members and

staff took this issue to Capitol Hill as part of our Advocacy

in Action campaign, ensuring elected officials understand the intense

opposition to TFL fees. Retirees already have fulfilled all the requirements

to earn their health care benefit, and MOAA will fight any attempts to

cut it, including fee increases designed to shift costs from DoD to seniors

who rely on TFL.

Click HERE

to read the complete article.

Click on the December 2024 Report above

and scroll down to pages 17 and 18 where you can read about the enrollment

fees. |

|

|

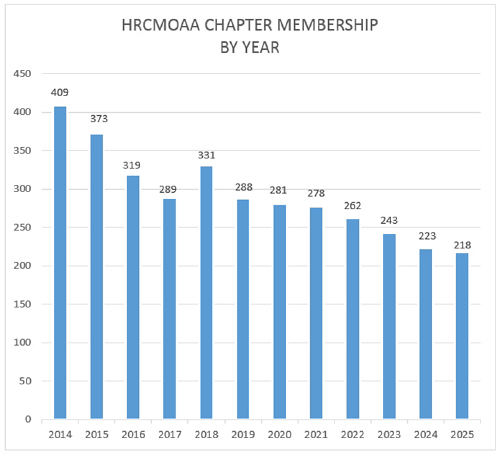

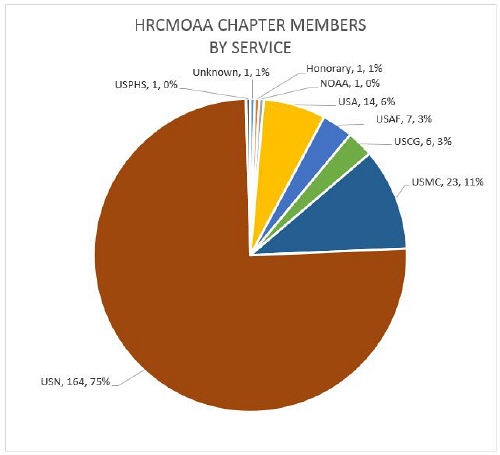

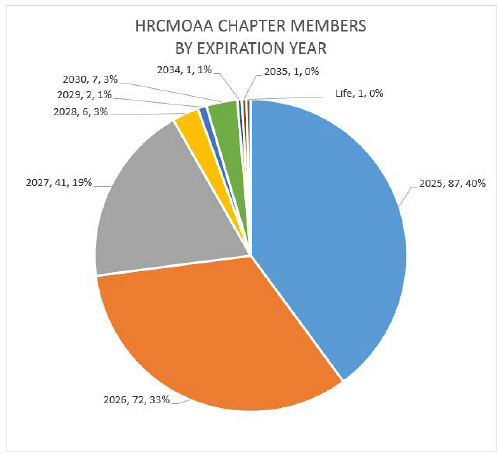

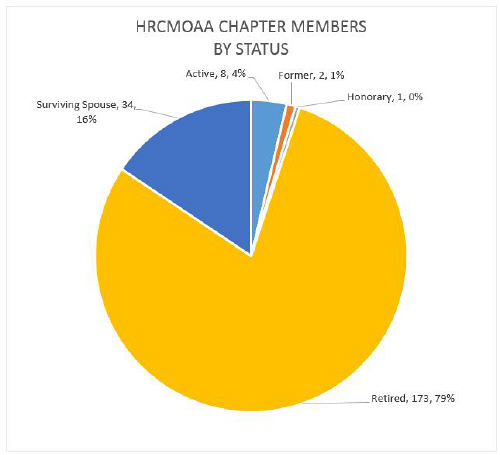

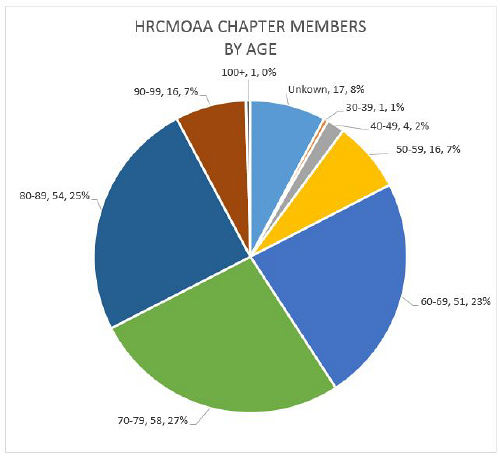

Statistics

About Our Chapter

|

Click on graph for a

larger view

|

|

|

|

|

|

|

Graphs are based on

chapter membership as of 1 Jan 2025

|

|

|

|

|

| |

| Copyrights Infringement

Notification

If you believe that any content

posted on the Hampton Roads Chapter Military Officers Association of America

(HRCMOAA) Website infringes copyright, you may send us a notification including

all relevant information: Notification

of copyright infringement

Copyright Notification

Guidelines

HRCMOAA respects third partyís

copyright, and it is our policy to respond to all notifications about copyright

infringement as established by applicable regulations. Once the notification

complying with these Guidelines is received, HRCMOAA may remove or disable

access to the allegedly infringing material or adopt further action that

we consider appropriate.

Copyright infringement

notifications must meet the following requirements:

-

The handwritten or electronic

signature of the person submitting the notification.

-

Identification of the copyrighted

work claimed to have been infringed, or, if multiple copyrighted works,

a list of such works.

-

Identification of the material

claimed to be infringing and that is to be removed or access to which is

to be disabled, as well as sufficient information to allow HRCMOAA to locate

that material.

-

Information to allow HRCMOAA

to contact the complaining party, such as an address, telephone number,

and, if possible, an email address.

-

A statement that the complaining

party has reason to believe that the use of the material is not authorized

by the copyright owner or the law.

-

A statement that the information

in the notification is accurate and true

HRCMOAA will follow the

procedure provided by applicable regulations to ensure compliance with

copyright. When a proper notification complying with the conditions above

is received, HRCMOAA will remove or disable access to infringing materials

as soon as possible. HRCMOAA will not necessarily send a confirmation regarding

the removal/disabling.

HRCMOAA Copyright Contact

Information:

HRCMOAA@gmail.com

|

|